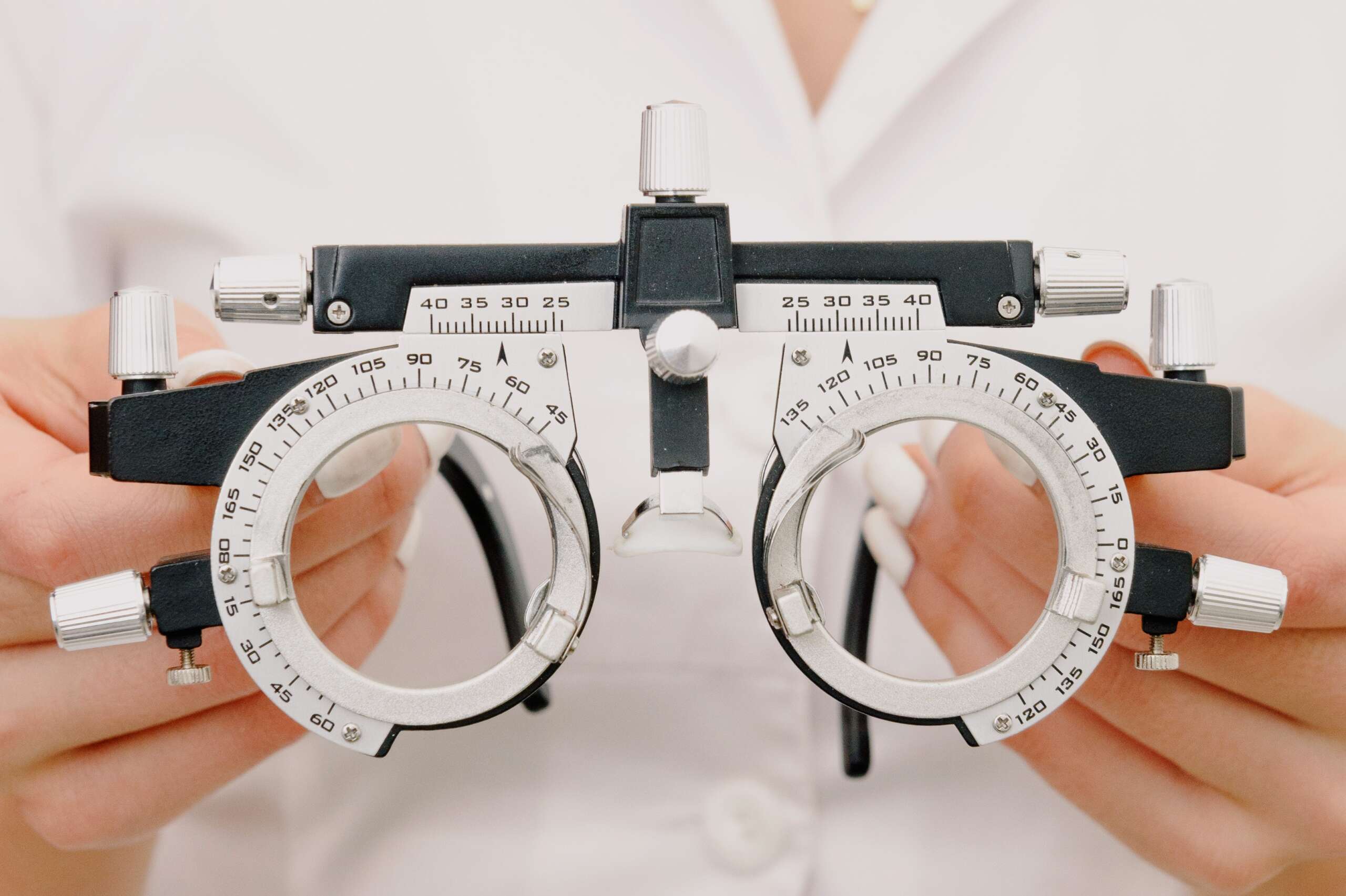

Medicare is a federal health insurance program that primarily provides coverage for hospitalization, medical treatments, and prescription drugs for people over 65 years old, younger individuals with certain disabilities, and people with End-Stage Renal Disease (ESRD) according to this site. However, many people wonder whether Medicare covers vision care costs, as vision problems are common among seniors. There are different Medicare coverage for vision care costs and what beneficiaries should know. You should also know the different parts of Medicare and how each component relates to vision care coverage.

If you are having visionary troubles, and you wish to go to a good doctor ensuring you do not waste your insurance on excessive treatments. You can book your very first appointment from ArabiaMD.

Table of Contents

I. Original Medicare: What Vision Services are Covered?

Medicare Part A

Medicare Part A is known as hospital insurance and covers inpatient hospital stays, skilled nursing facility care, and some home health care services. While Part A does not cover routine vision care, it may cover certain vision-related services in specific situations, such as if you require surgery or treatment for an eye injury or illness. It’s crucial to note that Medicare Part A will only cover these services if they are deemed medically necessary.

Medicare Part B

Medicare Part B is medical insurance, covering a wide range of outpatient services, including doctor visits, preventive care, and certain medical supplies. Under Part B, some vision care services are covered, but with limitations. Here is what Medicare Part B covers concerning vision care:

- Cataract surgery: Part B covers cataract surgery, including one pair of prescription eyeglasses or contact lenses following the surgery.

- Glaucoma screening: High-risk individuals, such as those with diabetes or a family history of glaucoma, are eligible for an annual glaucoma screening.

- Diabetic retinopathy screening: If you have diabetes, Medicare Part B will cover a yearly eye exam to check for diabetic retinopathy.

- Macular degeneration treatment: Part B covers specific treatments for age-related macular degeneration.

It’s important to note that Medicare Part B does not cover routine eye exams or corrective lenses, except following cataract surgery.

II. Medicare Advantage (Part C) and Vision Care

Medicare Advantage, also known as Medicare Part C, is a private insurance alternative to Original Medicare. These plans must cover everything that Original Medicare does, but they often provide additional benefits, such as vision, dental, and hearing coverage. The extent of vision care coverage varies between plans, so it’s essential to compare different Medicare Advantage plans before enrolling. Some plans may include coverage for:

- Routine eye exams

- Prescription eyeglasses or contact lenses

- Discounts on eyewear or vision correction procedures

III. Medigap and Vision Care

Medigap, also known as Medicare Supplement Insurance, is designed to help cover the out-of-pocket costs associated with Original Medicare, such as deductibles, copayments, and coinsurance. However, Medigap plans typically do not provide additional coverage for vision care services not covered by Original Medicare.

How Much Does Medicare Pay for Vision Care?

Medicare covers a significant portion, 80%, of the eligible costs associated with vision care services, treatments, and items such as eyeglasses. If you solely rely on Original Medicare, you’ll be responsible for covering the remaining 20% after meeting your deductible. For example, if the expense for a glaucoma test is $80, your share of the cost would amount to $16.

Additionally, when receiving vision care services at an outpatient hospital, you’ll incur a separate copayment for the hospital. The co-payment amount can vary but will never exceed the 2023 Medicare Part A deductible, which is $1,600.

Medicare-participating providers and suppliers accept a payment lower than their regular fees. When you choose a provider who participates in Medicare, the amount you owe will be based on this lower payment, thus lowering your out-of-pocket expenses and helping you save on vision care costs.

What if I need vision care that Medicare does not cover?

If your Medicare plan doesn’t cover certain vision care services, you have other avenues to access the care you need. The National Eye Institute’s website offers a compilation of resources for finding eye care at no or minimal cost.

Additionally, you might want to investigate private vision insurance plans or discount schemes. These plans usually present a range of coverage levels, from standard to more specialized care, enabling you to select the coverage that best suits your individual needs. When comparing plans, be mindful of any restrictions on coverage, network constraints, and extra expenses such as deductibles and co-payments.

Understanding the extent of vision care coverage provided by Medicare and other available options is crucial for maintaining good eye health. While Original Medicare offers limited vision care coverage, Medicare Advantage plans may provide more comprehensive benefits. Additionally, resources like the National Eye Institute’s website and private vision insurance plans can help bridge the gap for services not covered by Medicare. By carefully evaluating your individual needs and researching the various options, you can find the most suitable coverage and ensure you receive the necessary vision care to maintain a healthy lifestyle.